Hyperinflation is a state of economy in which the prices of goods and services rise at an extremely high rate. This can be caused by a number of factors such as too much money being printed, or a decline in the value of the currency. When hyperinflation occurs, it can be very difficult for people to purchase everyday items, and it can also be hard for businesses to stay afloat.

What is hyperinflation? (Definition #2)

Hyperinflation is a situation in which prices increase rapidly and uncontrollably, typically as a result of currency devaluation (Fiat money). The most famous example is the hyperinflation in the Weimar Republic in Germany in the 1920s, when prices increased by a factor of 100,000,000,000 over the course of a year. Hyperinflation can have devastating consequences for an economy, leading to widespread poverty and social unrest.

There is a lot of confusion surrounding the terms “inflation” and “hyperinflation.” This is because they are often used interchangeably, when they actually have different meanings. Inflation refers to a general increase in prices, while hyperinflation is a specific type of inflation that occurs when prices increase at an extremely high rate. Ream more about Inflation.

Causes of Hyperinflation

Hyperinflation is a very serious economic problem that can have disastrous consequences for a country. It occurs when there is a very high level of inflation, and it can be caused by a variety of factors.

Some common causes of hyperinflation are:

- Runaway government spending.

- High levels of government debt.

- Excessive money printing.

- Political instability.

Effects of Hyperinflation

Although hyperinflation is often seen as a purely economic phenomenon, it can also have significant social effects. For example, it can lead to social unrest and political instability.

Some of the effects of hyperinflation include:

- Prices will increase rapidly as the value of the currency falls. This can cause a lot of hardship for people who are living on a fixed income.

- The cost of goods and services will also increase, which can lead to shortages of essential items.

- Businesses may go bankrupt if they are unable to keep up with the soaring prices. This can lead to unemployment and social instability.

- The government may also become insolvent, leading to political chaos.

Examples of Hyperinflation

Zimbabwe hyperinflation example

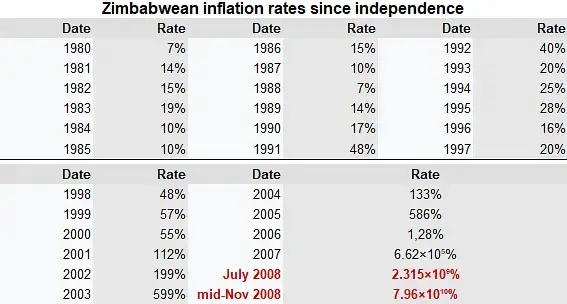

Zimbabwe is a country that is no stranger to hyperinflation. The most recent case of hyperinflation in Zimbabwe occurred in 2008-2009. At the height of the crisis, prices were doubling every day, and the country’s currency was essentially worthless.

For example, the annual rate of inflation reached 89.7 sextillion percent in 2008. This extreme case of hyperinflation caused widespread shortages of goods and food, and the collapse of the country’s currency.

The origins of Zimbabwe’s hyperinflation can be traced back to the early 2000s, when the government began printing money to finance its growing budget deficit. This resulted in an astronomical increase in the money supply, which in turn led to a rapid deterioration in the value of the Zimbabwean dollar.

Argentina hyperinflation example

In 1989 and 1990, Argentina experienced a period of hyperinflation. The monthly inflation rate peaked at 7,627% in June 1990. As a result, prices increased by an average of 3,500% per month. Read more about Argentina inflation rate.

How to Protect Yourself from Hyperinflation

Hyperinflation is a very serious issue and it can happen to any country. There are ways that you can help prepare for hyperinflation so that you are not left in the dark when it hits.

Let’s see how could you protect from hyperinflation:

- One way to do this is to keep an eye on the news and be aware of what is happening in the world.

- Another way to prepare is to have a stash of cash on hand in case things get bad quickly.

- It is also important to have a plan for what you will do if hyperinflation does occur.

- Have a backup plan for your job, your finances, and your home.

- If you live in a country that is prone to hyperinflation, it is also a good idea to have some of your money outside of the country.

- Invest your money in assets such as stocks, commodities, energy ETFs and the like that appreciate along with rising prices.

In conclusion, hyperinflation is a very serious issue that can have a negative impact on a country’s economy. It is important to be aware of the signs of hyperinflation and take steps to prevent it from happening.